It goes beyond market trends and technological advancements. Regardless of its downfalls, cryptocurrency marks an inevitable cultural change.

Many people have a lot of opinion about the world of cryptocurrencies and even more suspicion about the so called crypto revolution. But most of them have little to no knowledge or understanding about this infamous industry. These days you can hear a lot of talk about crypto breaking its promise or it’s always been too speculative and too risky. News of Russia banning crypto payments or Tesla dumping 75% of its Bitcoin holdings are not helping to paint a prettier picture.

But what people don’t realise is that, regarding crypto, we are currently in a phase which was very much expected by experts, long term investors and all those who dig a little deeper. And they are precisely the ones who are in it for the long run and are not hiding from this, so called, crypto winter.

The tale of the cryptoverse has its origins in the 2008 market crisis. Now that’s a whole other story but the main reason the crisis happened in the first place and hit us so shockingly is the same reason that brought the idea of decentralised and trustless financial system into the world.

What caused rise the rise of cryptocurrency?

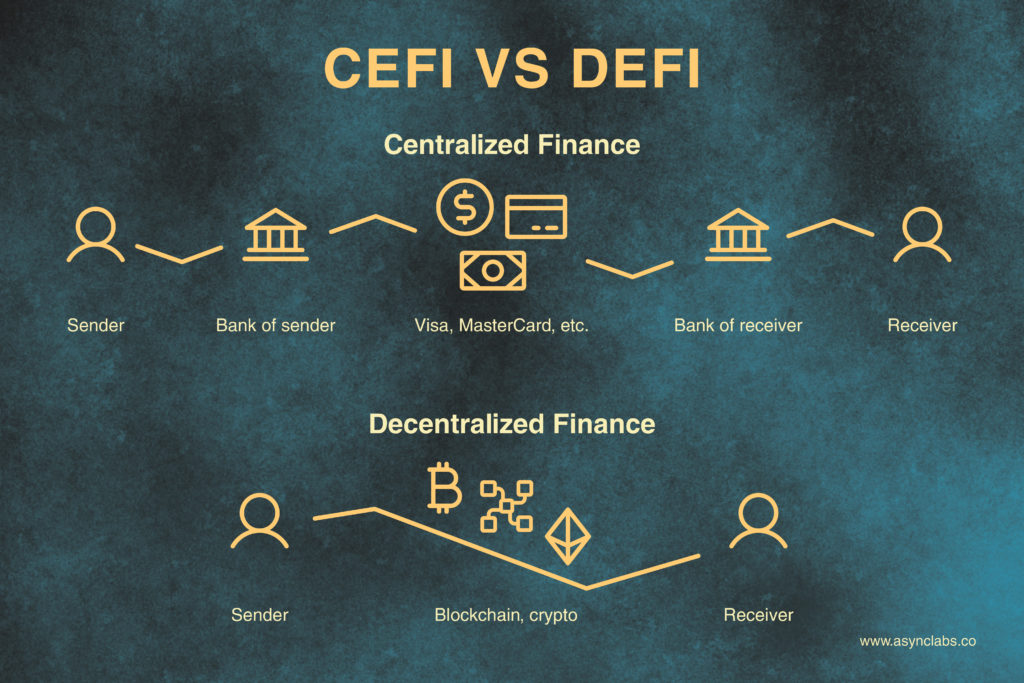

Simply put, we trusted and relied on centralised entities like banks and rating agencies to do their job. The basics of that system work like this: credit rating agencies do assessments and if they provide good and positive ratings the bank will see you fit and reliable for a mortgage. Now the idea was that these two centralised entities should work separately and independently from each other for the benefit of everyday citizens. Because they didn’t is the reason the whole market collapsed in 2008 and the idea of a cryptoverse was born.

At Async Labs David is a Business Development Manager and Editor in Chief of Crobitcoin, our internal project and one of the first and largest crypto news platforms in SE Europe. He has been following and educating the community about blockchain and the digital economy for quite some time now. His belief is that the downfall of the market in 2008 shaped the way in which the digital economy will evolve today.

Financial crisis in 2008 has shown the world that complete centralisation and the need for trust in financial institutions is deeply flawed. Those are “for profit” companies whose primary mission is to secure gains for their shareholders.

David Orešković, Business Development Manager

What is Cryptocurrency Revolution?

The initial promise of Cryptocurrency is to revolutionise the financial system. The goal was and still is, to create a system that would prevent a market collapse like the one in 2008 by changing it. The change would rely on a trustless system that works in a certain way and, without the banks and rating agencies, the only thing you have to rely on in this system is the public code. Basically what crypto and blockchain technology initially promised was to enable us to have immutable or unchangeable transaction records without third centralised parties.

Revolutionise is a key verb here because the emphasis is on the impact the changes of crypto would have on everyday citizens and the global financial market. The promise is that our daily routines regarding financial management will change and the mere point is not on the activities but the general mindset. That is why the change of the cryptoverse has cultural predispositions as well as the economic ones.

Like any other invention or new technology, development of blockchain and cryptoverse went through a couple of main phases and interphases, and we are currently in one of them.

Phase 1: Long live the code

Invention of Bitcoin automatically enabled us to, for the first time, trade and transfer digital value, without a third party or a mediator. This concept was not possible before Bitcoin. Without a third party like a bank, you could only transfer information, but not its value because there was no way to universally confirm it was transferred to a second party.

In the Bitcoin ecosystem miners are those who confirm the validity of transfer because they have an incentive to be truthful and are enabled to be objective. After validity is confirmed by more than 51% of the miners, the transaction is entered into the ledger. Miners don’t know between whom the transaction is taking place and they are rewarded once the transaction is fulfilled. So in the long run, all who are doing exactly what they should be doing are being rewarded.

David Orešković, Business Development Manager

Phase 2: Be smart or be not

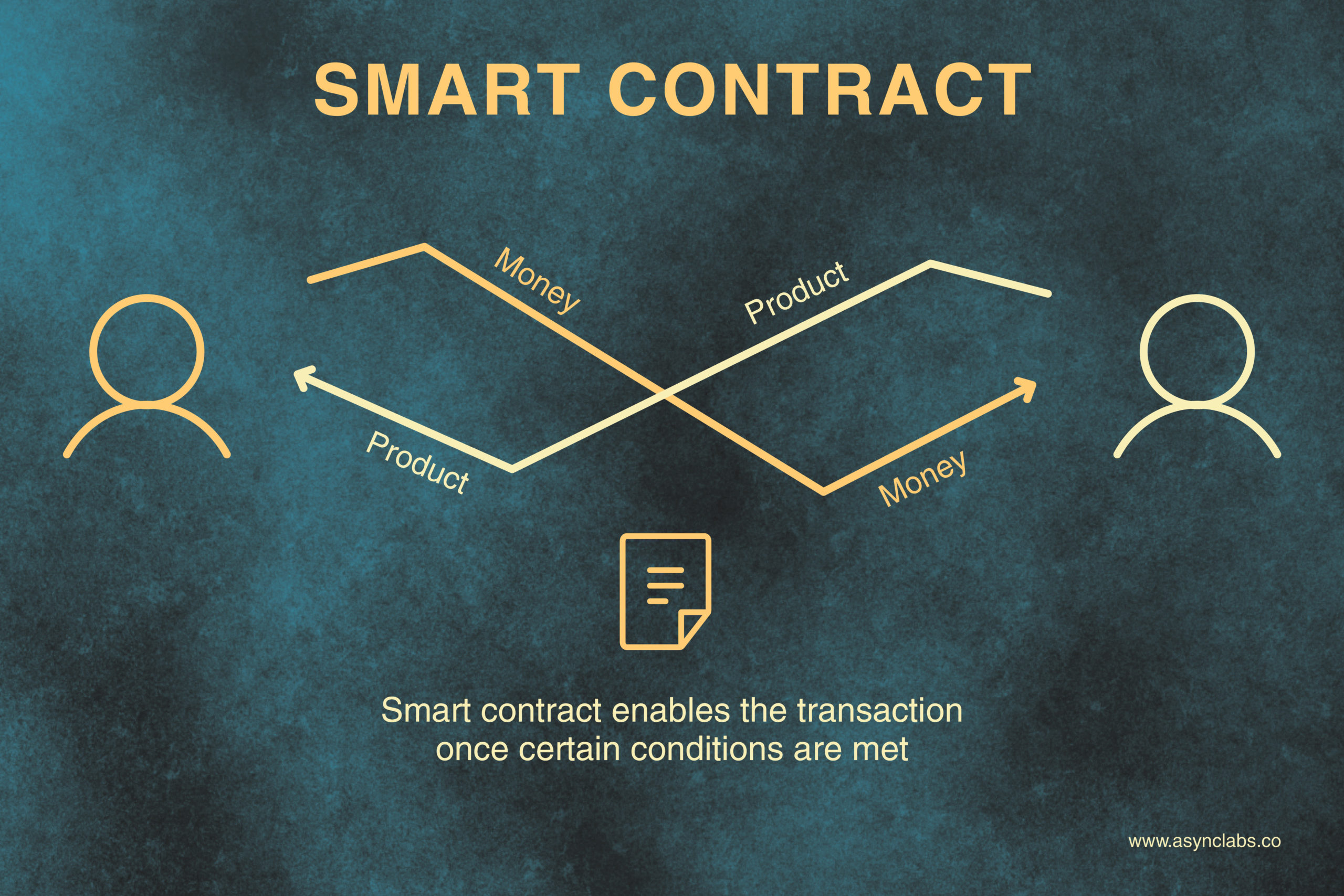

Ability to transfer values without third parties was great but after some time the community realised that these one way transactions are not suitable for complex transactions.

For example, you want to buy a car and you offer a couple bitcoins for it. You send the bitcoins but then you never receive the car because the seller tricked you which he was able to do because basically your arrangement was based on a word and a promise, nothing more.

And then came Ethereum and we were introduced to smart contracts. Their purpose is to enable the transaction once certain conditions are met and they become the base of the entire chain until 2018.

Although currently, smart contracts can be used only for digital assets like NFTs, the goal is to implement it in the general transactions ecosystem. But for that to be possible, blockchain needs to be lawfully and legally regulated. This would mean that if you sign a smart contract and buy a car for a couple of Ethers, if that car is not physically delivered, you have the legal right to sue the other party.

Phase 3: Beyond the digital

In order for smart contracts to be properly executed for off chain values (non digital, physical) we needed to have a confirmation of truthful off-chain information. Real life data such as temperature, height, colour, texture and so on need to be brought to the blockchain in order to include it into a smart contract so that in the end you can trade with real life, physical values.

This is where Oracle, a data provider, came into the picture. The most famous and successful blockchain oracle project is Chainlink, a decentralised oracle network built on Ethereum.

Chainlink is a decentralised oracle network that allows smart contracts on the blockchain to connect with data outside the blockchain in a decentralised manner. Although there are already oracles that allow the blockchain to access data from the outside world, they are usually centralised. This ties into the problem that without decentralised oracles, the decentralised nature of public blockchains becomes useless.

David Orešković, Business Development Manager

Phase 4: Digital revolution

With these three inventions began the new phase of Crypto with NFTs and decentralised finances or DeFi. The main goal of this crypto phase is to transfer the traditional financial system to a trustless digital network. This is of course challenging for many reasons. Our current financial system is enormous, with a long history and legacy, but still far from perfect. With the current crypto inventions and features it is not possible to further the implementation to the existing financial system because it is simply too large and complex. So currently we are waiting for new advancements that will make crypto more sustainable and accessible.

Cooldowns of Crypto Revolution

In between all these phases of discoveries there were cycles of cooldowns and market drops with high volatility rates. This is because all of these represent exciting new inventions that encourage a lot of hype around them which results with a lot of people chipping in, trying to get a piece of the cash cake. What most don’t understand is that even though these are all amazing technological achievements with a lot of potential, they are in the beginning phases of development which means they are probably flawed and risky. Despite continuous updates and changes, the whole system is very complex and not user friendly while people are very much used to comfort.

The technology is very young and new but also revolutionary. Currently we are experimenting with it and trying to implement it in different ways therefore errors and failures are normal and expected. All that is in a way necessary to after some time, end up with new technology which is of good quality, sustainable and will revolutionise many industries.

David Orešković, Business Development Manager

Those who are in the industry for some time now are used to cooldowns and are aware they are just a normality in market cycles. Since they are inevitable, one must look at the positive impacts these periods have on the crypto market:

Bear creates bull

Until now, almost all significant and game changing discoveries in the crypto industry have arisen during bear markets. Simply put, whatever is created and done in the bear market, carries out the bull market.

Bear markets are times when instead of chasing crazy and easy profits, real blockchain and crypto enthusiasts have time to develop solutions that will improve that….and other industries. For example, DeFi was one of the biggest trends in the latest bull market, but all the main DeFi developments happened during the last bear market.

David Orešković, Business Development Manager

The cleanse

Bear markets also mark a period which filters those projects that are for the long run and those that are not. This is why during bear markets we hear a lot of news about projects failing, companies going bankrupt and people losing their money.

For example, liquidity-strapped crypto lender Celsius Network recently filed for Chapter 11 bankruptcy protection in the Southern District of New York on Wednesday, more than a month after it halted customer withdrawals because of “extreme market conditions.” This was mostly caused by their irresponsible behaviour with their customers’ funds.

David Orešković, Business Development Manager

Why is Crypto crashing?

Even though these cycles and the current bear market might make a little more sense now, one question still remains. If the whole point of crypto is to be a new and independent financial system, why does it seem to correlate with the rest of the economic market?

The price of Bitcoin has suffered many ups and downs before and for the last couple of weeks it has been hovering around $20,000, which is 70% below its peak of last year. Furthermore, the entire market capitalisation of the cryptoverse has shrunk by more than two-thirds since November 2021. This is the largest downfall so far and as inflation continues to grow and recession is knocking on our door it doesn’t seem that the crypto market is doing any better than the rest.

Crypto market correlates with the general market. Of course it does. Crypto and blockchain technology are still in the very early stages of their evolution and as always, it all comes down to money. Or better said, the price of money.

Interdependence is inevitable

Ever heard about periods of cheap and expensive money? Probably not, because in general we are not financially educated in our school days, which is the main reason for many issues, but that’s a topic for another blog.

These money periods are reflected in interest rates. When they are low, people have tendencies to borrow more money and spend or invest in riskier assets to achieve higher returns. However, when interest rates go up, something that we are currently experiencing, money, or to be precise, returning borrowed money, becomes expensive which leads to dropdown in loans and deficit in risky and speculative investments. Since crypto is still considered a risky asset it is actually quite logical that its market is currently crashing.

Currently it is almost impossible for crypto to be independent from the rest of the market simply because there are too many factors that have an impact on its development and performance such as money value, interest rates, power expenses for miners, etc.

Crypto is still young to be independent from other market instruments, even gold is currently experiencing a 20% drop from its highs a couple of months ago. Crypto market is much smaller and therefore much more volatile than gold. You first need to walk so you can run, and we are still at least one market cycle away from that.

David Orešković, Business Development Manager

Price is what you pay, value is what you get

The truth is, with crypto, people have lost a lot of and have earned a lot of money. The simple reason for that is because when it comes to investing, crypto is still considered, and for a good reason, a speculative, high risk type of investment. While many earned fortunes, a lot lost a lot and for numerous reasons. While in many cases we can blame projects with false promises, scams and shitcoins, a lot lies on us.

People have tendencies to, instead of educating themselves, follow the herd. A lot made fortunes in 2017 and then again in 2021 with Bitcoin and Altcoins. Many others followed and invested their money expecting to get rich fast which is rarely a good investment strategy.

The main question here is “at which point did someone enter the market?” Many people started investing expecting to get rich fast, with little money. That usually ends up in catastrophe, so in the end, many lost almost all of their investments in crypto.

David Orešković, Business Development Manager

Belief despite of it all

Ever since Async Labs was founded in 2016 our main philosophy and goal was to become the industry’s game changers and innovators. That is why we choose projects that are new and unknown not just to us, but to the market in general. Even though this approach has proven many times to be risky and challenging it also enabled us to grow and to have a unique seat at the market table.

Our CEO Alen states: At the beginning, while we were just another agency in a row that deals with software development and marketing, blockchain technology is what offered us much greater opportunities in the market.

A road to the unknown

A great example is our client Revuto, a successful fintech startup that became the first project ever to be financed through a token sale on the Cardano network.

Despite our experience and portfolio of blockchain projects, working on Cardano was new, both to us and the entire market. Although the blockchain itself, together with the ADA token, is extremely popular, within the Dev community there are currently not many resources (other than the official ones) about Cardano. This meant that apart from developing the mobile wallet application itself, we had do independent research and educate our team while simultaneously developing the first such project on native Android and iOS platforms.

Although we had experience with several blockchain projects, this was the first time we developed on Cardano, which is new and very “young” in terms of development environments, SDKs and the developer community itself. We had to optimise everything well in order to be able to meet deadlines and at the same time maintain quality, and in the end see if and in what way it would benefit the end user. This required a lot of planning, architectural design, integrations and collaboration with the Revuto team in terms of business decisions.

Luka Klancir, COO

Despite all the unknowns and unexpected challenges, the development of this Cardano wallet turned out to be successful considering that it represented the first native wallet on this platform. Simply put, the wallet was not taken over and adapted to the needs of the project. It was created as a completely new product developed especially for the so-called Revuto ecosystem.

First of all, it was necessary to familiarise the team working on the project with the process, terminology and the whole concept. In addition to developers and quality assurance analysts, there are also designers, business analysts, copywriters and members of the marketing team. We had to do in-depth research on things that are quite unknown on the market and the developer community and combine our existing knowledge and experience about crypto with the new solutions we were discovering. Managing just that part of the process is very challenging, but we’re glad it paid off in the end.

Luka Klancir, COO

What is the real future of cryptocurrency?

To sum up, the world of crypto is facing many challenges and probably more yet to come. However, it also offers a lot of opportunities and a certain kind of change which will be highly impacted by blockchain technology, is inevitable.

As an IT agency, our goal is to influence the development of technology, which is also one of the main reasons why we choose blockchain projects that are also challenging enough to motivate the team in the long term.

Alen Huskanović, CEO

Interested in implementing a blockchain project? Don’t worry, we got your back! Get in touch and we’ll find the best solution for your specific needs.