Digital transformation in banking has become critical for financial institutions to stay competitive in today’s rapidly changing business landscape.

Traditional banks have always been an integral part of our lives. Be it saving money, loans, or making transactions, we have always relied on them. But with the rise of technology and digitalization, banking has undergone a massive transformation.

In today’s world, a digital transformation is no longer an option; it’s a necessity. Banking is no exception. As more and more customers turn to digital banking solutions, financial institutions must stay ahead of the curve and innovate to remain competitive.

From using big data to leveraging AI to streamline the customer experience, banks are rapidly adapting their business models to keep up with the modern consumer’s demands.

Are you looking for a way to make your banking institution run more efficiently and stay ahead of the competition? Digital transformation is the answer.

Let’s dive deeper, explore the key benefits of digital transformation in banking, and see how to embrace and use the technology at your fingertips.

3 benefits of digital transformation in banking

Increased customers

One of the significant benefits of digital transformation in banking is the ability to reach a broader customer base. With the proliferation of smartphones and the Internet, customers are increasingly looking for ways to access banking services from the comfort of their homes.

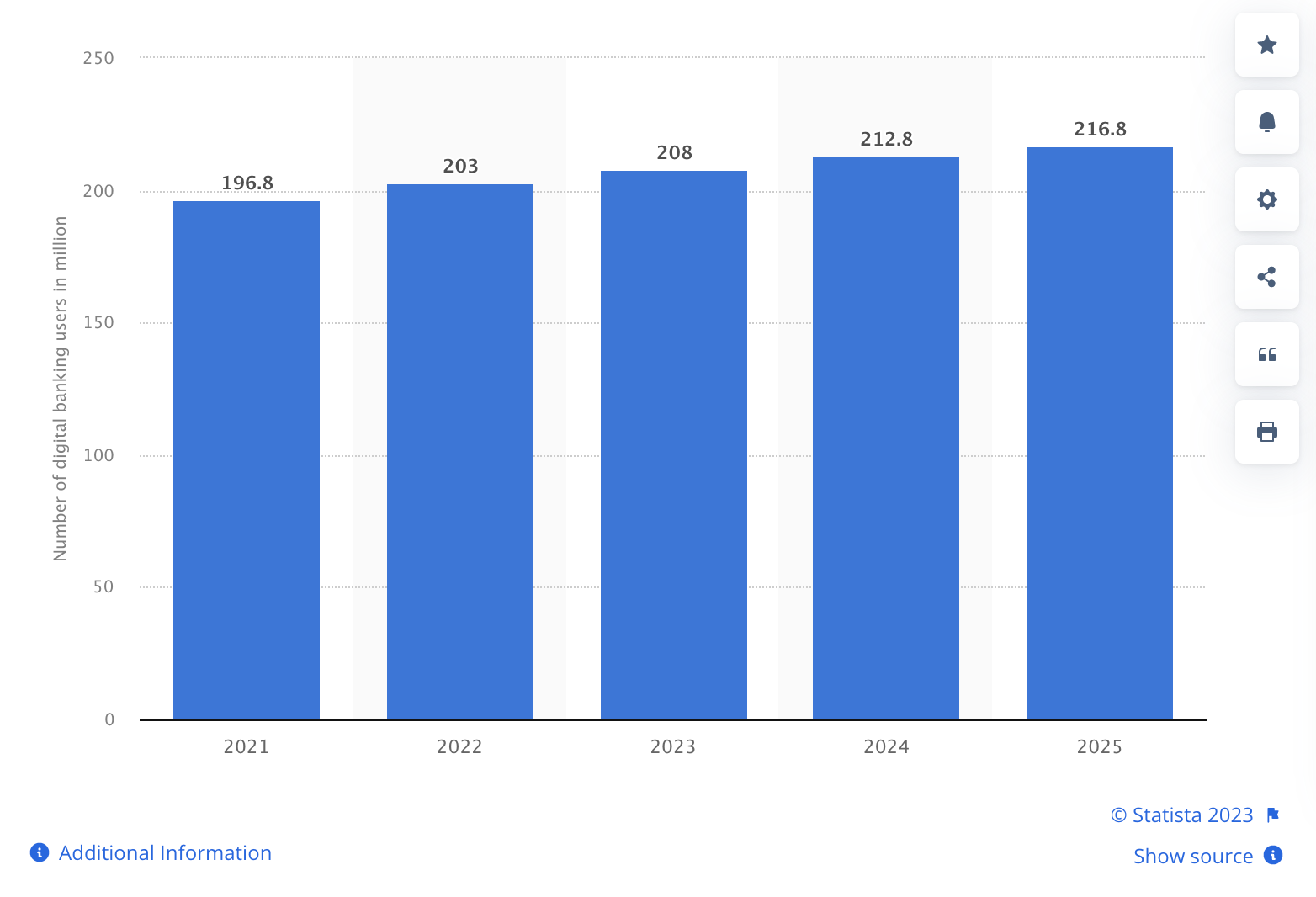

Digital transformation has allowed banks to offer online, mobile, and electronic payments, making banking services more accessible to a broader audience. Digital banking is becoming more popular with consumers. In 2022, 203 million people used digital banking services. This number is projected to reach 216.8 million by 2025.

4 ways banks can increase customer base

There are several ways that banks can increase their customer base through digital transformation:

- Develop a mobile banking app: It allows customers to access their accounts from anywhere, anytime, providing them with more flexibility and convenience. The app lets customers quickly check their account balances, make transactions, and access customer support.

- Provide self-service options: Customers today prefer to handle routine banking transactions themselves. By providing self-service options, such as online account opening, online loan applications, and digital payments, banks can improve the customer experience and free up resources to focus on more complex issues.

- Improve digital security: One of the customers’ biggest concerns about digital banking is their personal and financial information secure. Banks can increase customer confidence in their digital services by investing in the latest digital security technologies (such as implementing multi-factor authentication, biometrics, and other security measures) and educating customers about best practices for online security.

- Faster Transactions: With digital banking, customers can carry out transactions in real-time, making it quicker and more efficient. Customers can easily transfer money, pay bills, and access their accounts without waiting in long lines or traveling to a physical branch.

By investing in digital transformation initiatives prioritizing customer experience, banks can attract new customers, retain existing ones, and ultimately increase revenue.

People change. So do their banking behaviors.

As more people turn to digital solutions for their banking needs, banks have an opportunity to increase their customer base.

According to a study conducted by Accenture, younger consumers, especially Gen Z, demand an exceptional digital payment experience on all platforms – most notably on their smartphones. And all they want in return is to be compensated through targeted rewards, offers, and discounts.

This study demonstrates that banks must invest in digital transformation initiatives to remain competitive, follow new trends, and attract new customers.

Better customer experience

One of the most significant benefits of digital transformation in banking is the improved customer experience. By offering digital services, banks can provide customers with a more convenient, personalized, and streamlined experience. This includes online account opening, online loan applications, and digital payments.

For instance, banks can use data analytics to gain insights into their customer’s behavior and preferences and use this information to offer personalized financial solutions. According to a report by Accenture, 83% of customers are willing to share their data with banks in exchange for customized services. Therefore, banks that embrace digital transformation can build a loyal customer base and improve customer retention.

Digital transformation has also led to the introduction of chatbots and virtual assistants, which offer 24/7 support to customers. These tools use artificial intelligence to interact with customers and provide real-time assistance, improving the overall customer experience.

Customer experience performance

According to McKinsey, banks have learned in the past decade that better experiences for customers lead to increased throughput in their sales journeys (and therefore more revenue) and lower friction in service journeys (and therefore lower cost to serve).

This shows that banks can significantly improve the customer experience and retain more customers by investing in digital transformation. In short, customer experience performance does not require a trade-off with financial performance. It is a primary driver of financial performance for many banks.

It’s no secret that customers expect more from their banks today – they want personalized services, convenience, and fast resolutions to their queries. All these expectations can be met through digital transformation initiatives such as offering mobile banking apps, providing self-service options, making payments without having to visit a physical branch location, and utilizing AI chatbots to answer customer queries quickly and accurately.

By leveraging technology such as AI and machine learning, banks can provide personalized experiences tailored to each customer’s individual needs and preferences — which is something that traditional brick-and-mortar branches cannot offer.

96% of customers say customer service is essential in their choice of loyalty to a brand. And to make customers happy, it’s a great path to experience growing revenue. That’s why banks must invest in digital transformation initiatives to create a better customer experience and satisfaction levels.

Streamlined operations and efficient risk management

Digital transformation makes it easy for banking institutions to integrate and streamline their operations. With efficient data management and analytics, banks can support their decision-making processes by analyzing customer trends and preferences.

This data-driven approach enables banks to identify new opportunities to increase revenue streams. Moreover, digitization lets banks track their transactions in real-time, helping detect and respond to potential fraud/risks much faster.

With cloud-based solutions, banks can ensure regulatory compliance needs are met more efficiently and cost-effectively.

Examples of digital transformation in banking

Digital transformation has revolutionized many industries and banking is no exception. With the rise of new technologies, the banking sector has enhanced customer experience, streamlined operations, and improved risk management. Here are some examples of digital transformation in banking:

Blockchain technology

Blockchain is a decentralized and secure ledger technology that enables banks to perform transactions securely, efficiently, and transparently. This technology is widely used in the banking sector for cross-border payments, trade finance, and identity verification.

Async Labs brings extensive experience in the IT industry. Our expertise with blockchain provides a wide range of Blockchain services, from consulting, analyzing, and system architecture design to integration with clients’ systems and implementation.

We worked on the first app built on Cardano – Revuto, a blockchain-based solution for all subscriptions. The app allows you to manage, track, maintain, and cancel any subscription and prevents unwanted subscription charges. Our team built Revuto’s platform by leveraging our expertise in blockchain development, smart contract programming, and quality assurance.

Since there were only a few resources and information about the Cardano blockchain in the development community, we had to work independently on research and education of the team while simultaneously implementing the acquired knowledge in such a pioneering project.

Using Artificial Intelligence (AI)

AI is used in the banking sector to enhance customer experience, automate processes, and improve risk management. Banks are using AI for activities such as chatbots for customer service, fraud detection, credit scoring, and investment advice.

Collection, management, and analysis of customer data

Banks are collecting vast amounts of data about their customers, which can be used to improve customer experience and create new revenue streams. With the help of big data analytics, banks can analyze customer data to gain insights into customer behavior, preferences, and needs and tailor their services accordingly.

These are just a few examples of how digital transformation shapes the banking sector. As technology evolves, we expect to see even more innovative solutions that will transform banking and the financial services industry.

Takeaway

In conclusion, digital transformation is critical for banks looking to remain competitive in the modern digital landscape. By embracing digital technologies, banks can achieve better operational efficiency, enhanced customer experience, and increased customer base. This is all essential for driving success.

With the right approach, banks can leverage digital technologies to become modern, data-driven organizations prepared for challenges. As technology evolves, investing in digital transformation initiatives is critical for any forward-thinking bank seeking success in a competitive market environment to meet the changing needs of its customers.

The power of digital transformation in banking is not just about more than embracing new technologies. It’s about changing the way we think about banking services. Embracing digital transformation may require a shift in mindset, but the benefits are clear – staying competitive and meeting the evolving needs of your customers.

By implementing digital transformation, banks can offer customers a more convenient and accessible banking experience, personalized services, faster transactions, and enhanced security. It can also enable banks to streamline their processes and reduce operational costs, increasing profits, customer satisfaction, loyalty, and growth.

Are you ready to take the next step toward digital transformation and drive growth and innovation in the banking industry? Let’s work together to build a future where banking services are accessible and convenient for everyone.