2023 is a perfect time to build a fintech app.

Fintech is every company that provides financial services through software or other technological solutions, including mobile application payments, investing, and cryptocurrencies.

Every time you withdraw money at an ATM, you use the fintech service. It’s the same with paying via mobile apps. We are already so used to these services that we can hardly imagine our lives without them.

In the fintech area, the emphasis is on the younger population who have already learned most of the online products and services.

According to some recent research, Generation X and Z in the last few years have met all their financial services needs via the mobile Internet, choosing companies or financial institutions, mobile and flexible channels for conducting transactions.

Fintech empowers consumers to take control of their financial lives, leading to much greater financial literacy and improving their financial situation and outcomes.

What exactly is fintech, what does it mean for the average person, and how to build a fintech app? Let’s dive deeper and find out!

What is fintech?

FinTech (short from financial technology) is a term used to describe the impact of new technologies on the financial services industry. It refers to various products, applications, processes, and business models that have transformed traditional banking and financial services.

The name fintech refers to companies that, with the help of modern technology, offer an individual innovative replacement for standard banking services.

Although technological innovation in finance is not new, investment in new technologies has increased significantly in recent years, and the pace of innovation is growing exponentially.

Whether you pay your bills via your bank’s mobile app, check your account balance, withdraw money at an ATM, use one of the online platforms for money transactions – you use fintech technology.

What are the main areas of fintech?

There are different types of fintech apps depending on the financial area they deal with. Here are some examples of fintech providing new financial concepts and influencing consumers’ economic outcomes.

Mobile banking and mobile payments

Consumers today seek more financial benefits, so many financial institutions are adopting or expanding their mobile banking capabilities and replacing traditional payment methods. For example, banks offer mobile banking options. If you ask young people under 30 how to pay, they will choose the mobile app’s options whenever they can.

Cryptocurrency and Blockchain

Cryptocurrency exchanges have connected users who buy or sell cryptocurrencies such as Bitcoin, ETH, etc. Blockchain solutions aim to reduce fraud by storing origin data on the blockchain.

Trading

Trading and investing have improved with the adoption of fintech. Through algorithms and identifying trends and risks, readers can run large amounts of data. Without the help of AI technologies, information from big data is often unreadable and unstructured.

Consumer Finance

Fintech consumer finance apps help users manage their finances. These apps provide users with relevant tools and features to plan budgets and manage their spending well and wisely.

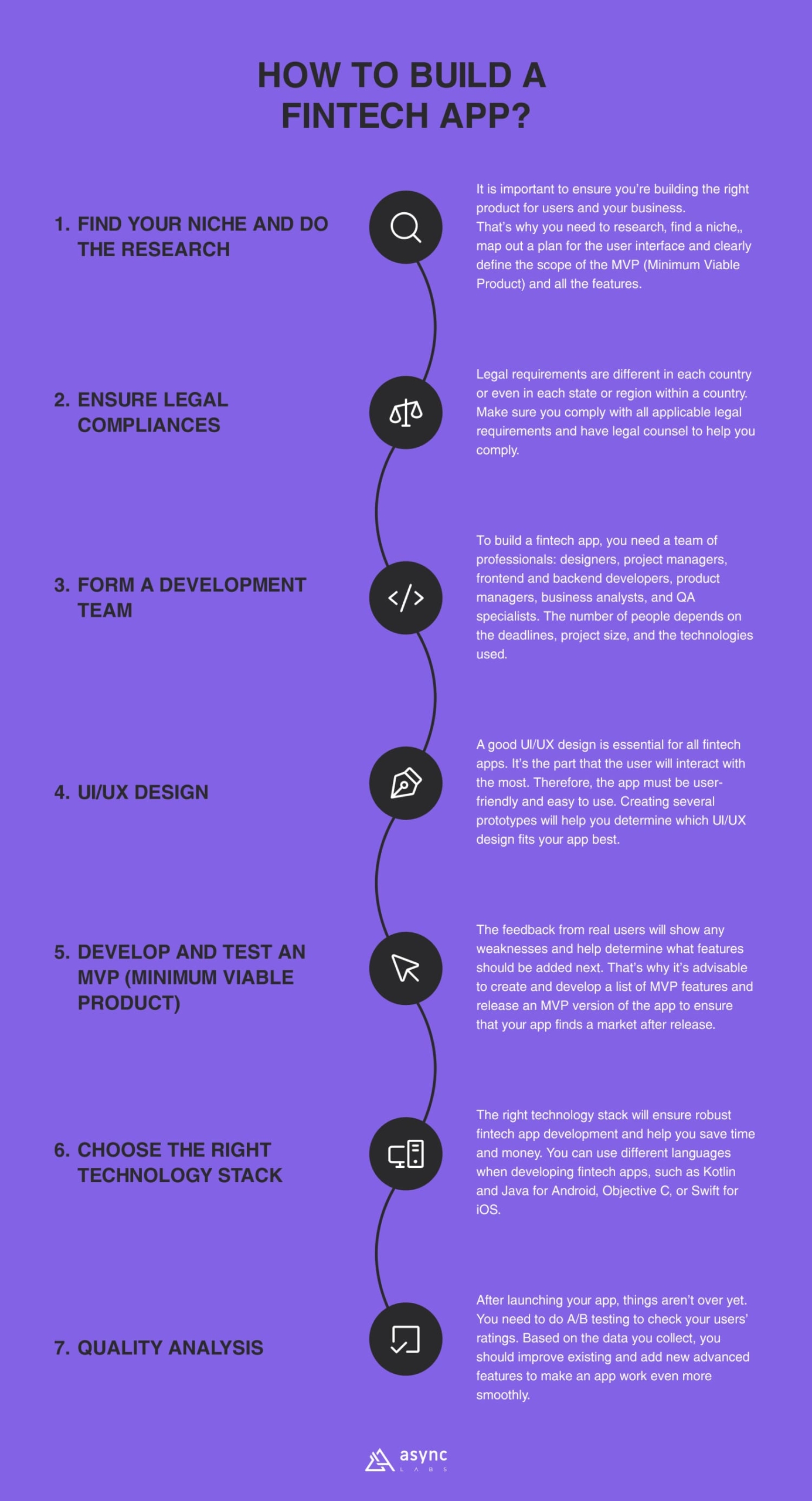

How to build a fintech app?

Building a fintech app does not differ much from any other application. Let’s see what steps are needed to build a fintech app.

Find your niche and do the research

Before developing an app, you have to ensure that you’re building the right product for users and your business. That’s why you need to find a niche, do the research, map out a plan for the user interface and clearly define the scope of the MVP (Minimum Viable Product) and all the features.

Here are some fintech niches:

- Payments

- Wealth management

- Money transfer

- Insurance

- Lending

- Personal finance

- Cryptocurrency

- Trading

Ask yourself the following questions that form the core methods of market research:

- What problem do people in this niche have?

- How is my fintech app going to solve the problem?

- Who are the competitors in this niche?

- Why would they use my app?

- Will it be profitable?

Ensure legal compliances

Legal requirements are different in each country or even in each state or region within a country. Make sure you comply with all applicable legal requirements and have legal counsel to help you comply.

In the U.S., for example, there is no single body overseeing fintech regulations, so a fintech startup has to comply with various federal and state laws.

The situation is similar in most countries. Governments worldwide have not yet responded to the new fintech industry. Fintech companies have to figure out how to navigate hundreds of laws, regulations, and standards.

Form a development team

To build a fintech app, you need a team of the following professionals:

- Designer

- Project manager

- Frontend developer

- Backend developer

- Product manager

- Business Analyst

- QA specialist

The number of people on your team depends on the deadlines, the size of the project, and the technologies you choose. Each team member should be familiar with the essential workings of the fintech app development company.

For your next fintech project, choose the software development company based on its experience, communication skills, and hourly rates.

Before the development process, a professional software development team will ensure you’re on the same page, provide a technical specification, and deliver the project according to plan and within deadlines.

A technical specification should consist of a thorough plan and estimate for each sprint, wireframes, design, and acceptance criteria. This document will help you and your development team develop a clear understanding of the project.

UI/UX Design

A good UI/UX design is essential for all fintech apps. It’s the part that the user will interact with the most. Therefore, the app must be user-friendly and easy to use.

Creating several prototypes will help you to find out which UI/UX design fits your app best. This step is no longer a problem if you hire an experienced team.

What makes a good UI/UX design for a fintech app?

- the app should be straightforward

- features should be easy to use and navigate

- users should easily find options

- avoid unnecessary and confusing features

- the colors shouldn’t be too dull or too bright

Develop and test an MVP (Minimum Viable Product)

It’s advisable to create a list of MVP features, develop them, and release an MVP version of your app as soon as possible to ensure that your app finds a market after release.

The feedback you get from real users will show you any weaknesses and will help you easily find out what features should be added next.

Another important and helpful step is to analyze your direct competitors with similar apps and competitors that offer other ways to achieve similar goals. Check what your competitors have and think about building smarter, faster, cheaper, and more user-friendly apps.

After publishing an MVP, you can use mobile analytics to collect data and learn about user behavior. Initial reviews and new data will help you build the list of features you want to add next.

Want to start planning your Minimum Viable Product now? Find more information about the MVP process in our ebook and download the free minimum viable product template.

Choose the right technology stack

Choosing the right technology stack to build a fintech app with high-value features is essential. The right technology stack will ensure robust fintech app development and help you save time and money.

Using the right platform, programming language, or third-party tool will positively impact your app’s security, scalability, and even performance.

There are different languages that you can use when developing fintech apps. You can opt for fundamental technologies such as Kotlin and Java for Android, Objective C, or Swift for iOS.

Include the most important features

Here are some essential features to include in your fintech app:

Security

Because of the most sensitive customer data, security is paramount for fintech apps. Incorporate two-factor authentication with voice, facial, and fingerprint recognition for login. Ensure the app only displays the last three digits of the card number and limit failed login attempts.

Notifications

Notifications give a feeling of personalized user experience.

Because of the personalized experience, it is essential to provide users with an update on new app features and special offers. Notifications can increase conversion rates, help keep users engaged, and track actionable metrics.

QR code and scan

This is by far a convenient and error-free way to conduct monetary transactions. QR coding and scanning also save users time.

API integration

Connecting with other apps to share data can significantly increase your revenue and add advanced features to your product. For example, API integration allows users to access their account information, check where the nearest ATM is, pay bills, credits, and fines via an app, make an online purchase with PayPal, etc.

Quality Analysis

After launching your app, things aren’t over yet. You need to do A/B testing to check your users’ ratings. Based on the data you collect, you should improve existing and add new advanced features.

If you want your fintech app to be better than the ones your competitors have, it should work smoothly, be easy to use, secure, and be easily customizable by users.

One of the successful fintech projects we have worked on is the blockchain-based solution Revuto. It is a one-stop solution for all subscriptions. With Revuto, you can manage all your subscriptions through a virtual debit card that allows you to track, maintain, and cancel each subscription.

With the Revuto app, you can easily choose between your credit or debit cards to protect yourself from unwanted subscription fees by only authorizing a specific payment.

The end product is a complete platform covering the entire user lifecycle, from the acquisition side to the application’s end-user.

Time to build a fintech app

Fintech’s potential is huge – from improving existing services to creating completely new ones. Fintech platforms are intended for all users of financial services who are undergoing digital transformation with the help of the Internet and mobile applications.

Developing a fintech app is by no means an easy process. If you want to be successful and become one of the future unicorns, the key is to offer customers more than the standard solutions.

Looking to build an exceptional fintech app? Start moving towards your goal now! We can help you develop a secure and high-performance mobile or web solution. Get in touch with our experts and let us know your requirements.