How does the Blockchain KYC process verification process work in practice?

When you want to open a bank account, open a savings account or invest, you usually have to visit the company office or a bank, meet with their representative, identify your documents, and sign a contract. Quite a time-consuming process, right?

According to research by a leading corporate brand, Thomson Reuters, it takes 32 days for corporations to complete KYC checks. Meanwhile, 89% of clients report bad KYC experiences.

Besides taking a lot of time, it is also considered the most costly policy to implement and maintain, with costs for financial entities climbing up to $60 million per year. With blockchain technology, we can dramatically reduce the time needed for authenticity checks.

Sharing KYC information on Blockchain would allow financial institutions to improve customer experience, deliver better compliance outcomes, and increase efficiency.

What are the flaws of existing KYC processes, and how the KYC Blockchain process verification works in practice? Discover more in this article!

What is KYC?

Do you know your customer?

Each company must verify user identity, which is especially important for financial institutions.

KYC stands for “Know Your Customer”. It is a business process that verifies the client’s identity to prevent money laundering, identity theft, financial fraud, etc.

KYC protocols assist businesses in ensuring they know who they’re doing business with. This procedure involves verifying your identity and address using a government-issued document with a photo (an identity card or passport).

Effective KYC involves knowing a customer’s identity, their financial activities, and the risks. It is a great technology solution that allows you to verify your identity from the privacy of your home. The fundamental practice is to protect your company or organization from fraud and losses from illegal funds and transactions.

The flaws of existing KYC processes

Typical KYC procedures involve long-standing practices of collecting and processing information. During the registration process alone, companies lose more than half of their potential new customers.

Existing KYC processes result in errors, increased costs, and loss of revenue. Consumers expect and deserve a better, more functional, user-friendly, and less repetitive experience.

Current KYC processes today are inefficient and quite outdated. Financial institutions must conduct lengthy and costly checks to verify their customers’ identities and protect user data.

To cope with growing regulatory requirements, institutions must find innovative technology to develop their existing processes. How to resolve the pain points in the KYC journey?

Best of Blockchain and KYC

When we combine, for example, a referral program with blockchain, we can track all the outflow tokens that are later released to users.

We have proof of record that certain things have been met. Due to KYC and verification, the user gets a reward on their wallet. This is the end of the whole KYC process.

KYC and blockchain aren’t really that connected, they’re two different services, but together they make a good combination.

For example, when a user conducts KYC, verifies the account, and gets tokens, that record is written on the blockchain. It’s impossible to receive a reward if the user has not made KYC and all other related items.

Blockchain-based KYC utilities can help bring cost savings to any industry that relies on identity verification. They can be easier, faster, safer, and more efficient than traditional verification procedures.

The blockchain architecture provides a modern way forward with immutability and security features that help give greater integrity and trust in data.

Benefits of blockchain as the foundation of a viable KYC utility

Greater operational efficiency

In the early stages of the KYC procedure, blockchain can significantly reduce the time and effort required, speeding up customer onboarding, and reducing corresponding KYC and regulatory compliance costs.

Real-time up-to-date customer data

Each time there is a KYC transaction, the latest information will be put into the shared distributed ledger. This allows multiple institutions to rely on those same checks and information.

Immutability and data transparency

Blockchain technology allows any institution member to prove to regulators that the secure blockchain platform provides trustworthy information. A blockchain KYC utility offers a streamlined way to gain fast and secure access to clean, up-to-date customer data, reducing overall KYC processing time and associated costs.

How does a Blockchain KYC implementation work?

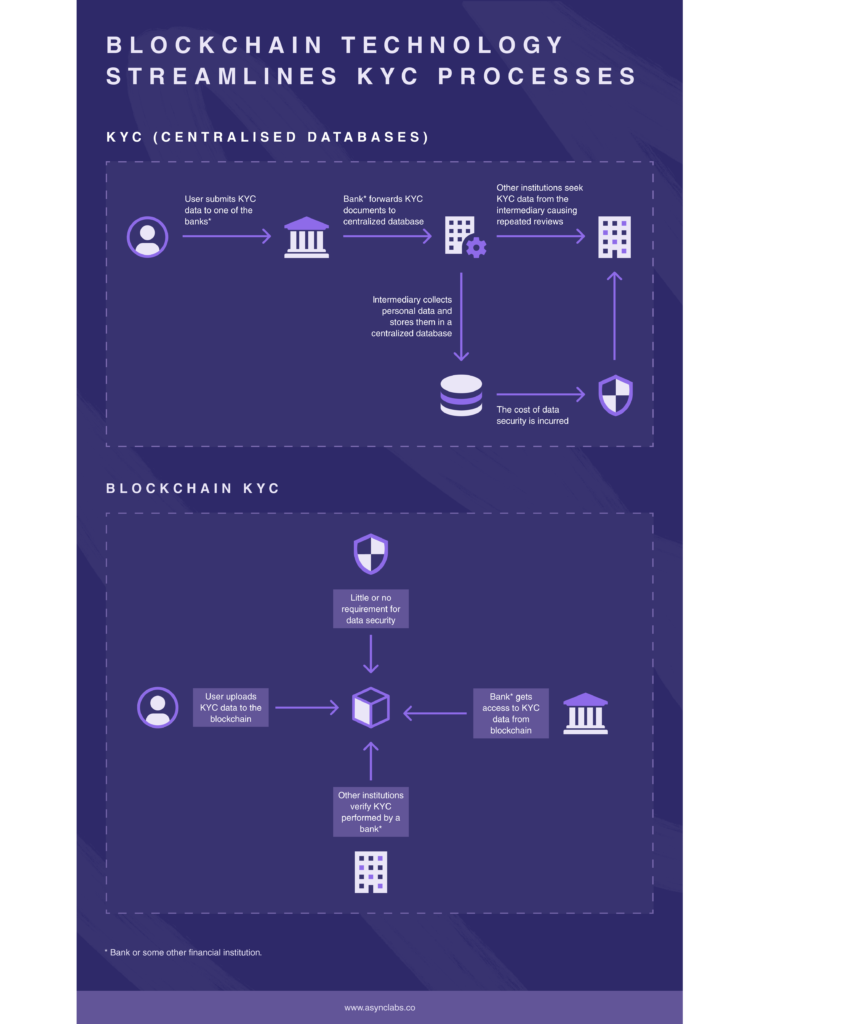

In the traditional KYC system, each bank conducts its own identity check. This means that each user is checked individually by a different organization or government structure. It is time-consuming to check each identity from scratch.

The blockchain architecture and distributed ledger technology (DLT) enable us to collect information from various service providers into a cryptographically secure and unchanging database that does not require a third party to verify the authenticity of the knowledge.

It enables creating a system where the user only needs to go through the KYC procedure once to verify their identity.

In this example, we explained the verification process in the banking system, but the same process can be applied to any financial institution or service.

KYC Blockchain verification process in practice

- For the KYC process, a user submits documents to one of the banks (in this example) from which they wish to use any service, make a transaction or take out a loan.

- The individual participants (banks, government agencies, companies, or users) are responsible for collecting the personal data stored in a decentralized network.

- The bank checks and confirms the KYC passage if everything is in order.

- All parties can regulate and control the KYC process. The bank takes responsibility for entering the data about the user into the blockchain platform, which can be accessed by other banks, organizations, and government structures. The system monitors changes and updates user data, and if someone violates the rules, all parties get notified.

- When a user wants to use the services of another bank, that second bank accesses the system to confirm the user’s identity.

- Access to the user’s data is based solely on the user’s consent. The user must log in to cryptocurrency transactions and use the private key to initiate the exchange of information.

A good example of blockchain KYC implementation (Revuto)

KYC is undoubtedly one of the areas that blockchain stands to benefit most. Moreover, it is already powering many different KYC solutions.

Many companies have already recognized the advantages that this new technology processes over existing systems. It is used in international money transfers, electronic medical records, home purchase solutions, etc.

KYC (Know Your Customer) verification is an integral part of Revuto. Revuto is a digital solution for subscription payments built on Cardano’s scalable smart contract network.

Revuto turns your digital wallet into a “digital bank”, supporting recurring payments for all the goods and services you use. As such, it is important that customers on the Revuto platform are verified as card providers and issuers require KYC details about those customers.

Furthermore, we use KYC to verify the users that are referred to the platform, and based on those validations they get payouts and incentives.

Our role was to construct a system around the requirements and enable architecture to support it (new users registration via referral links, KYC users, token release during KYC, etc.).

Async Labs provided the infrastructure and application to provide all invite links and deep links, propagate everything through the application, implement KYC processes on users who came through referral links, and verify them for token release.

Shaping the future of KYC

Trusted blockchain technology brings new ways to better perform your customer due diligence and benefits both consumers and businesses.

It has the power to raise your customers’ trust in your business and lower the risk of your customer having their data stolen compared to other centralized services.

We believe that blockchain can transform the KYC paradigm, making it better and accessible to all. If you share the same opinion and look to implement new innovative solutions into your business, get in touch with us!