Blockchain technology reaches into all spheres and industries. Some are less prone to disruption while some a bit more. So how is one of the biggest industries of oil and gas standing in that ring? Ready for disruption? Absolutely.

According to research from IBISWorld, a globally recognized company in the field of business intelligence, the total revenue for the O&G industry was close to 2 trillion USD in 2017. This is only the number for the Upstream sector which is dealing with research, development, and operation of oil and gas fields.

The Upstream sector contributes to roughly 2-3% of global GDP. In this article, we will try to explain what impact Blockchain technology in the Oil and Gas industry could have.

If you add into that the midstream and downstream sectors which are focused on transport, refinery and sales of oil and gas products which also amounts to roughly 3 trillion USD, then we are coming to a percentage of 6-8% of global GDP. This directly translates to the enormity of capital that is being shifted inside this whole industry.

Technological innovations and the rise of the Blockchain

The adoption of modern technologies in the O&G sector is not an uncommon thing. Various companies are providing advanced solutions and applications to the players. The upstream side is especially fond of those.

However, the problems arise in the “back-office” functions like the all existing supply chain, procurement and mostly all activities related to finances. These aspects of the business have mostly stayed untouched by innovation which opens the doors to new digital solutions and blockchain fits naturally into this narrative.

In its last research, Deloitte has set a value proposition for the Oil & Gas industry. The first step is to decide if blockchain is applicable in the industry. To do that, four key areas have been located and are set to model the discussion and lead key decision-makers towards conclusions.

- Transparency and Regulation

- Security & Cyber Threats

- Mid-Volume Trading

- Smart Contracts

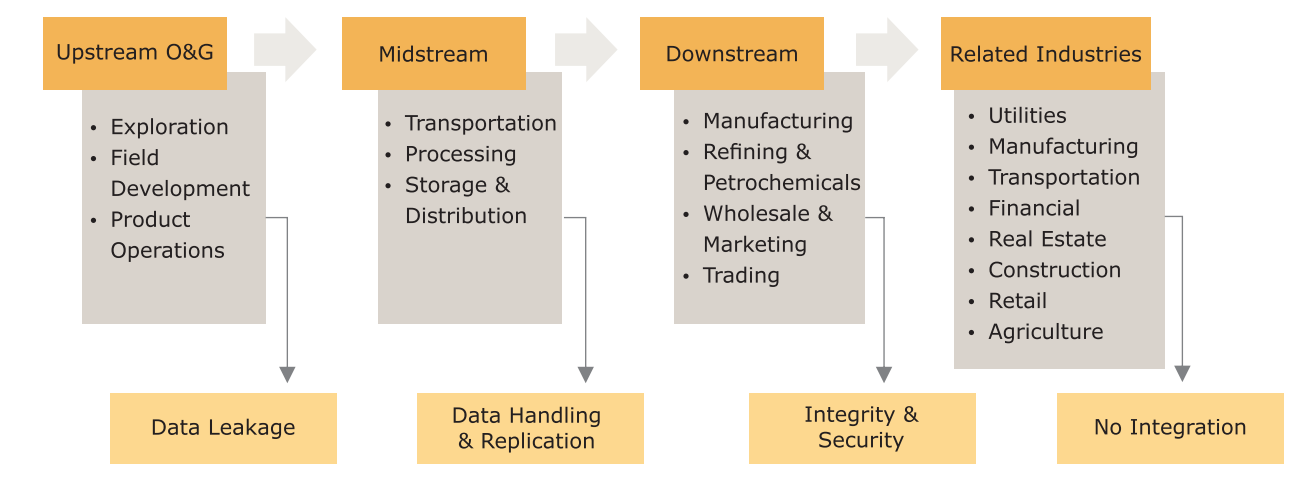

The O&G Industry is currently divided into three main sectors that compose the complete supply chain in the industry. Those are Upstream, Midstream and Downstream companies. Researchers from TATA Consultancy services have also located four indicative problems that are emerging in each of the sectors and how can blockchain solve those issues.

The O&G Value Chain – TCS

Likewise, the aforementioned sectors are characterized by significant investments between cooperating parties, especially on the Upstream side. Frequent ownership changes, transactions, and information exchange are essential processes due to the nature of market price action for oil and gas derivatives.

Because of those features, the industry is a perfect candidate for blockchain technology, notably in the area of ownership conversions, cost-sharing and contracting between several parties.

Concerning that, the whole regulatory side of the domain is heavily dependant on reporting to governmental bodies which adds a dimension of transparency that is already inherent in blockchain tech.

Possibilities of blockchain applications in oil and gas

That some players have already ventured into R&D in this space, best speaks the example of Gazpromneft.

Refueling for airline companies

A fantastic industry use case is coming straight from the biggest Russian operator for refueling of airplanes, Gazpromneft-Aero.

Together with the S7 airline they have developed and implemented a blockchain-based smart contract (AFSC – Aviation Fuel Smart Contract) that speeds up the current speed and efficiency in reciprocal settlements during the airplane refueling process and also automizes planning and accounting in fuel logistics.

This is one of the first blockchain implementations on the Russian market and with it, airline companies have a chance to facilitate instant payments for fuel without prepaying or overpaying. Likewise, the whole process of bank guarantees and financial risk is removed due to the smart contract, and that adequately reflects on the lowered costs of personnel and manual labor.

Aforementioned goes directly with research done by Accenture:

” Using such a blockchain process, Accenture estimates that an O&G company could save at least five percent in freight spend through improved invoice accuracy, reduction of overpayments, and disintermediation of third party service providers. For example, a firm with $10 billion in annual revenue, and $600 million in freight spend, could see a reduction of five percent in its costs, or $30 million in savings.”

Trading mechanics of the Oil and Gas industry

Oil is one of the most famous trading commodities on world markets. Price movements and volatility remain present all the time as a massive amount of information is influencing the price.

Currently, the whole system is based on several very complex ledgers that track trading and transactions over this commodity. These systems are centralized and incredibly hard to manage as they are open to manipulation, hacking and corruption.

But what exactly is the value proposition for commodity trading in the O&G Industry? By implementing blockchain tech, there is a possibility to reduce costs that are associated with updating, maintaining and securing the trading system. Consequently, it lowers the costs related to data management, visibility, settlement drawbacks, conflict resolution, and inter-system comms.

BTL Group, an enterprise blockchain company has recently finished a pilot project with ENI, BP, and Wien Energie. The pilot has demonstrated how the use of blockchain technology could cut costs of gas trading by 30%-40%. The company also plans to test the platform with other commodities.

On that note, blockchain tech can be implemented into the exchange of specific data related to the operations of certain midstream companies.

Decentralized Data Exchange for Pipeline Industry (PD-DEX)

Decentralized Data Exchange for Pipeline Industry (PD-DEX) is a distributed system based on blockchain technology which allows for an exchange of data between users or stakeholders while securing the integrity and transparency of the given data. This directly shifts into increased trust between stakeholders that the data wasn’t maliciously used, modified or manipulated.

The targeted challenges and issues that appear in «traditional» access to data from companies that are in the business of gas, oil and water transport (midstream companies) are mostly of legal and integration nature of sharing that data outside of corporate boundaries.

Async Labs is currently in R&D stage of a platform based on PoA (Proof of Authority) consensus algorithm where the so-called validation nodes are respectable stakeholders from the oil & gas industry like the midstream companies, research centers, technology providers and other subsidiaries.

The platform is modeled in such a way that the data is anonymized and transferred between two parties willing to do a data-set exchange under a specific classification while all other stakeholders and users can confirm the transaction and validate its trustworthiness.

The goal of this project is to develop a functional prototype and a simulation of data exchange with a combination of real and fabricated sets of data as to prove the technical feasibility and functionality of the platform on a broader set of data and a scalable on-boarding of new users/clients.

PwC research lays out the benefits and criteria under which blockchain technology systematically fits into the given domain of issues:

- Sharing data between multiple parties

- Updating data between multiple parties

- Verification requirements

- Cost complexity and intermediates

- Interactions based on previous transactions

A glance into the future of the Energy sector

The energy sector is one of the foundations of today’s modern society. On the way to a greener and efficient system, blockchain technology will play a significant role in the optimization and cost efficiency-boosting of the whole market.

The ultimate goal is to drive the core elements of interaction between companies from analog and full of friction into natively digital implementations. Those elements are money, securities, trust, agreements, and identity. These elements are inherent to every industry and demand processes and tools like stamps, ink, centralized ledgers and are open to subjective jurisprudence as well as human error.

The Oil & Gas Industry is no exception here, and to make the industry more efficient, layers of natively digital infrastructure are needed. That infrastructure is currently being developt locally with companies that we mentioned above.

With the optimization and growth of internal projects, whole industries will start advancing towards the next step, and that is interoperability and networking.

This article was also published on the biggest Croatian News Portal.